Inside the 2001 there was a crash throughout the housing market when you look at the the us. Creditors and Wall surface Path composed an unstable ripple centered on sub-best mortgage loans for reason for avarice. It really triggered a failure of housing marketplace and people whom ordered homes having sub-prime mortgage loans forgotten everything. Are formulated housing was section of it collapse and you may inventories dropped by 90% in the 2001.

Different reasons for brand new failure could be talked about inside the greater outline lower than however the small answer is corporate and you will banker avarice. Funds were awarded which they know had been impractical to-be reduced and they made use of arcane accounting means to relieve the issuance away from the loan once the money. So it led to producers and you can dealers increasing to meet up the brand new erratic demand of course, if brand new loans inevitably went with the default this increase day extension sank every are made housing market since it didn’t afford the expansions they’d engaged in immediately following providers dried out.

To own were created housing, Environmentally friendly Tree Financing, afterwards bought of the Conseco, is the number 1 culprit. Larry Coss is actually new chairman and you can leader just who already been the brand new problem. The guy began a habit titled gain discounted accounting. This is certainly a prefer label to own saying earnings you haven’t won yet ,. Basically it considers winnings from money given as instantaneous despite if the mortgage is paid down or perhaps not. This is certainly an incentive while making money to the people who’d little possibility to repay all of them. It didn’t care and attention if for example the mortgage try paid back, only it absolutely was produced. Green Forest filed profits away from $dos mil that simply didn’t can be found and you may Larry Coss acquired $2 hundred billion when you look at the incentives based on which sit. This might be a real way of measuring earnings.

As a result of Eco-friendly Tree’s successful functions, most other fighting loan providers started doing a comparable anything. Really was basically unaware Larry Coss got prepared the fresh books and you can consider these were copying a well established design. Needless to say, sound judgment will have told people its thinking that so it was not sustainable but as usual with finance companies and you can Wall surface Road avarice played a major factor. Now the entire banking marketplace is issuing these unsustainable sandwich-finest finance and that composed a big demand for are created construction. A responded because of the massively growing. Of many in past times winning best-proprietorship businesses went societal and you will entered the latest Wall surface Road crowd in which only greed issues. That it produced some thing infinitely even worse as unethical conversion process strategies emerged promoting, or in other words conning, the newest residents towards items they could not manage or suffer. The best pyramid design developed in which for as long as the latest sub-perfect financing were awarded for new are produced property the fresh new individuals hid the newest unstable strategies happening. As with any pyramid strategies in the course of time the newest sufferers dried up plus it every collapsed using the whole housing market down that have it.

Green Tree is actually the bank you to been the fresh new drama from inside the sub-finest are manufactured casing money however, other establishments entered inside later

Certain businesses endured. People who hadn’t obtained greedy and you may continued to provide quality factors below secure finance requirements. This type of couple businesses are now the latest spine of one’s are created homes globe. High quality build and fulfilling customers’ requires are now actually this new goals out-of progressive are designed construction. The firm design means the grapevine and recite team.

Houses pricing were rising faster than profits. Are available residential property rates about 50 % doing conventional webpages-based houses. He’s HUD certified so that the top-notch structure and energy show try secured. Progressive are available property are often of higher quality than very stick-mainly based home. There are several secret laws and regulations to making a financial investment in the a made simplycashadvance.net long term installment loans no credit check domestic that, an investment.

step one. Score home financing, not a chattel financing. A home loan is a diminished attract financing provided to a financial investment supported by a home more than an extended-identity. These types of mortgage is gloomier notice given that property has actually really worth throughout the years. Chattel fund is private assets. This type of financing are highest desire that’s shorter-name because assets bought is expected to help you depreciate.

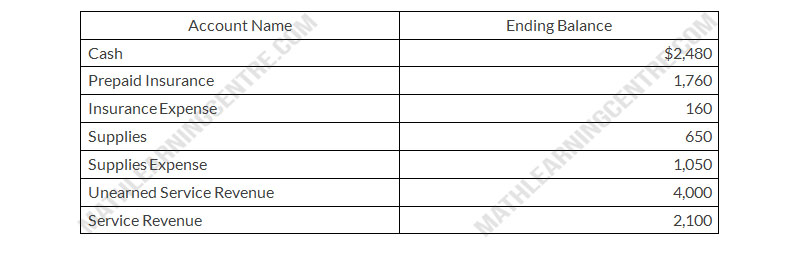

Standard accounting behavior will be to number the latest money since the loan are paid off

dos. Very own the latest house you reside is put-on. You simply can’t get home financing otherwise own the new residential property while wouldn’t like an excellent chattel mortgage if you’re able to rating home financing. Once you buy your are formulated domestic it would be encumbered that have the house or property therefore it is an individual resource.

3. Put your house toward a permanent base. Of several were created land are put for the lower than legitimate fundamentals because he’s small and you may cheaper. It’s just not beneficial. Bad foundations will cause the house to compromise and you may warp diminishing their really worth. Be sure to has a powerful long lasting base while the home will be a secured asset in the place of a beneficial depreciating liability. In addition to as with buying new homes, having a substantial basis will help you to score home financing as an alternative out of a good chattel financing.

cuatro. Include advancements for example a storage, porch, greenhouse, or really works shed. Such affixed developments raise up your are available house on arena of stick-created construction growing the well worth together with fulfilling rules within the specific portion out-of are designed property. Brand new improvements create your are created home indistinguishable on stick-depending property.

Other great news for brand new residents would be the fact recently Fannie Mae and you may Freddie Mac, federal housing financing institutions, have begun to buy are produced mortgage loans to increase these types of funds to deal with the new construction crisis. It indicates it’ll be easier discover a genuine financial rather than good chattel financing on a produced home a home financing. Manufactured homes seems is the future of homeownership throughout the All of us. It is definitely a choice worthwhile considering.